Monmouth Students Helped Teach Area Teens, Boost Engagement with the Material

WEST LONG BRANCH, N.J. — The Leon Hess Business School (LHBS) at Monmouth University has just completed the second semester of a program designed to augment the personal financial literacy requirement for New Jersey high school students. More than 130 students from five high schools in Monmouth and Ocean counties participated in the program.

This requirement is mandated in the “21st Century Life and Careers” portion of the New Jersey Student Learning Standards. To help school districts reinforce the financial literacy standard, LHBS developed a pilot program with two high schools in 2016.

“Having no background in financial literacy, many students are ill-prepared to make fiscally responsible and sound decisions about money,” said LHBS Dean Donald Moliver. “They do not understand concepts such as simple and compound interest, the time value of money, budgeting, credit, and the importance of saving. Accordingly, poor decisions often lead to larger problems such as poor credit, bankruptcy, and the inability to purchase a home.”

He also noted that for these types of programs to have a lasting impact it is optimal to reach students who are in their freshman year in high school if not earlier. Moliver, who made the decision to develop the program, said that the business school has a responsibility to provide programs like this free-of-charge to the community — especially to members of the community who may be most at-risk.

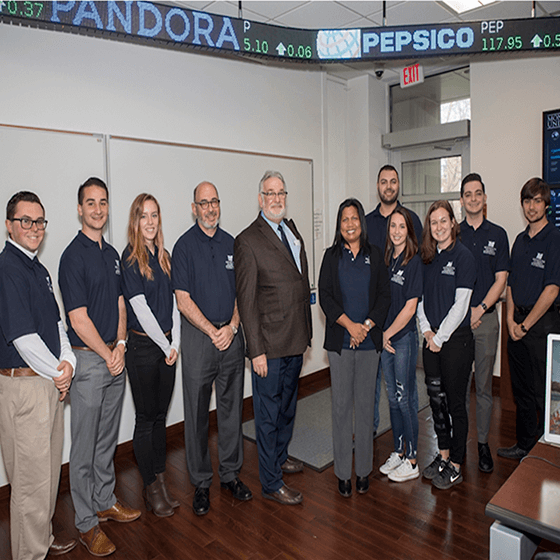

Specialist Professor P. Jeffrey Christakos (fourth from left), Dean Donald Moliver, and Assistant Dean Janeth Merkle are surrounded by Monmouth University students who assisted in the financial literacy program (from left) Joseph Breen, Joseph Madaio, Casey Selleroli, Gianni Mazzone, Kylie Seka, Katarena Brannick, Greg Nardiello and Vincent Miele.

According to Assistant Dean Janeth Merkle, LHBS took its cues from a study that buttressed Moliver’s arguments and concluded that first-year college students who had taken a high school financial literacy course were significantly more likely to be financially responsible than their peers who did not.

“It’s about learning personal finance; and about the importance of higher education while providing opportunities for our students to engage with the community,” explained Merkle. She also said that LHBS paid for transportation and other costs for the schools that participated. The program was funded, in part, with support from New Jersey Manufacturers Insurance Group.

Merkle said that the high school instructors shared that this was the first time many of their students had been on a university campus. They said they felt that exposing students to the campus was an important, value-added, experiential component of the program.

The high school student participants were selected through a competitive selection process by the partner high schools’ teachers and administrators. They came to the Monmouth campus for three individual three-hour sessions during which they worked through modules on goal setting, career planning, higher education, budgeting, investment and credit.

Developing a More Engaging Curriculum

Merkle said that after an assessment of the pilot, the curriculum was refocused to include more interactive and engaging activities.

She also recruited a new professor to lead the program.

P. Jeffrey Christakos is in his first year as a full-time specialist professor of accounting at Monmouth, after having taught at the university as an adjunct previously. He is also a certified financial planner and certified public accountant who has worked in the accounting and financial services industry for more than three decades. Outside of the university, Christakos is a partner and the lead advisor at Westfield Wealth Management. He also has a personal mission for the financial literacy program.

Christakos said that when he asked high school students what their life and career goals were, many of them replied that they wanted to become professional athletes. Concerned, he spoke to one of the high school teachers who told him, “This is the message that they have. This is how [many students from low-income households] believe they can get out of poverty.”

But he knew this was not the case. Christakos said that because he grew up in an impoverished childhood, he understood the appeal of that narrative, but, he continued, “this is not how they get out. That’s doomed for failure. So, my mission became to show them a different mindset in a voice that they could relate to.”

To create a counterargument to the standard discourse, Christakos and Merkle decided to use Monmouth students as co-teachers to deeply engage with the high school students. To help them recruit these students, they turned to Walter Greason, dean of the university’s Honors School.

“We were fortunate that Dr. Greason also has a strong passion for financial planning and literacy and he volunteered to recruit some of his students,” said Christakos. “And, as it turned out, many of them were my students as well, so it was a great connection.”

Greason, who teaches in the department of history and anthropology, has a research focus on the comparative, economic analysis of slavery, industrialization, and suburbanization.

“Financial literacy is the bedrock of economic independence in the United States,” he noted. “It is literally the reason that the American Revolution was fought. Without economic freedom, political freedom is almost meaningless.”

Greason said that the United States has built a modern economy that teaches people how to be consumers and debtors but he doubts that even the most educated members of society are prepared to address the challenges that the Founding Fathers laid out more than two hundred years ago. He said he hopes the university can take the lead in making more young New Jerseyans financially literate.

University Students’ Same Surprise

Like her fellow Monmouth student/teachers, sophomore Kylie Seka of Winslow, N.J., said that she was surprised by how engaged the high schoolers were during the program. “It was amazing to see how much they actually wanted to learn and take away from the program.”

Even though fellow sophomore Gianni Mazzone of Freehold Township, N.J., took financial literacy classes when he was in high school, he said that he was “very pleasantly surprised” that high school freshman and sophomores were grasping concepts like compound interest and investment strategies.

The only Monmouth student who participated in both the pilot and the revamped program was graduate student Greg Nardiello, 23, of Monroe Township, N.J. He had worked closely with Merkle during the program’s inaugural run and she invited him to participate again. Although he had worked with students in financial literacy before, he also found himself “surprised” by their levels of engagement.

“I came into the project expecting to deal with students who were not interested in what we were teaching,” said Nardiello, “but I found that after adjusting the material to suit the students that they were very engaged and eager to learn even more than what we were teaching.”

Jaclyn A. Headlam, the program director of The SPOT – School Based Youth Services Program at Asbury Park High School, agreed. She said that her students were “thoroughly engaged.” Headlam attributes this engagement to the Monmouth program’s hands-on activities and the use of college students as co-instructors with whom her students could relate.

In an e-mail, Headlam noted that “these programs are ESSENTIAL,” [her emphasis] and that even though she described herself as a “young adult,” she also reported learning skills to begin preparing for her own retirement while she chaperoned her students on their visits to campus.

“These lessons can never be taught too early,” she said.

Peer-to-Peer Financial Advice: Save

When prompted to give advice on financial literacy to their fellow Monmouth University students, Mazzone, Nardiello and senior Casey Selleroli of Ringwood, N.J., all stressed the importance of a commitment to saving money for the future. Selleroli said that she also was inspired by the younger students’ enthusiasm for learning about financial responsibility.

As for Christakos, that’s what he hoped would happen for both the high school and the university students.

“I believe that we should have a strong community service component and I think that all of our students are getting the message that everyone has a talent that they can and should share with other people.” The student participants in this program, “are special people with great abilities. I think there’s an obligation for all of them to share their talents,” he said.

Katarena Brannick, a 19-year-old Monmouth sophomore from Brick Township, N.J., summed up the message of the program with her own aphorism: “Better to be literate today than in debt tomorrow.”

Students from Asbury Park High School, Jackson Liberty High School, Keyport High School, Long Branch High School and Manasquan High School participated in Monmouth University’s Fall 2017 financial literacy program.

Moliver says that LHBS is committed to continuing and expanding the program and offering more advanced courses. The program will again be offered during the Fall 2018 semester and he hopes that even more high schools will be able to participate.

For more information on the high school financial literacy project from the Leon Hess Business School at Monmouth University, visit www.monmouth.edu/business-school/financial-literacy-project/ or contact Assistant Dean Janeth Merkle at 732-571-3483 or jmerkle@monmouth.edu.